Real-world asset tokenization is one of the most popular narratives in blockchain. It is one of the biggest potential use cases for blockchain technology and could spur the next significant digital transformation of traditional industries.

This new narrative is also directing large investments into the real-world asset tokenization market, especially into products & services that are in development. The goal is to grab a big share of this potentially lucrative market and bring tokenized assets into a particular blockchain ecosystem.

In this blog, let’s discuss how much the real-world asset tokenization market can grow and why blockchain developers are focusing their efforts on it.

As mentioned in a previous blog explaining the two main types of asset classes, real-world assets are tangible in that they have some sort of physical component to make them real in the sense of being concrete or having material properties.

These can be currencies, collectibles, real estate, fine art, commodities such as precious metals, diamonds, raw materials, and more.

Traditional digital assets are intangible such as stocks, bonds, intellectual property, financial derivatives, etc.

Both types of assets can be digitally represented and transacted as a token issued on a blockchain.

Related reading:

- Asset tokenization 101

- Asset tokenization real-world case study – tokenization of diamonds

- How tokenization can impact the premium spirits industry

In some cases, this can be done quickly using smart contracts and tokens.

In other cases, this can be more complicated as some of these assets are subject to stricter regulations and compliance measures. ]

Yet, the technology and potential exist for real-world and traditional digital assets to be brought into a blockchain network through tokenization, and then for the token to be transacted and recorded on that network.

The unique benefits of asset tokenization include:

- More liquidity for the asset as global investors can access the token in real-time

- Greater transparency, accountability, and security as transaction history can be searched in real-time, records are immutable, and token metadata can contain relevant information related to the asset

- Less friction for international transactions and quicker settlement

- The fractionalization of tokens enables more investors to buy and asset holders to more easily sell

It is a little tricky to estimate the actual valuation of the current asset tokenization market due to different methods of estimation.

However, one of the most useful examples is looking at stablecoins which are one of the earliest forms of asset tokenization.

A stablecoin is a digital blockchain-based token that is backed by deposits of fiat currencies and other financial instruments, in essence, tokenization of currencies. Some of the most common ones in circulation are Tether USDT and Circle USDC which are based on the US dollar.

On the other hand, stablecoins that use cryptocurrencies as a reserve and algorithms to create a peg with the U.S. dollar or other fiat currency are not considered real-world assets. These types of assets are called synthetic assets as they mirror the properties of a real-world asset, but do not rely on the ownership of the original instrument. In most cases, these types of tokens are excluded from the total market calculation.

Analytics firms such as 21.co value the current asset tokenization market (as of writing) at around $87 billion with stablecoins accounting for 97% of that total value.

This means that other use cases for asset tokenization such as commodities, real estate, collectibles, stocks, bonds, etc. have yet to take off and can significantly expand in the years to come.

Now that we have an understanding of the current size of the asset tokenization market and its reliance on stablecoins, we can discuss some basic projections.

The list of real-world and traditional digital assets that can be tokenized is almost endless, so there are a lot of possibilities.

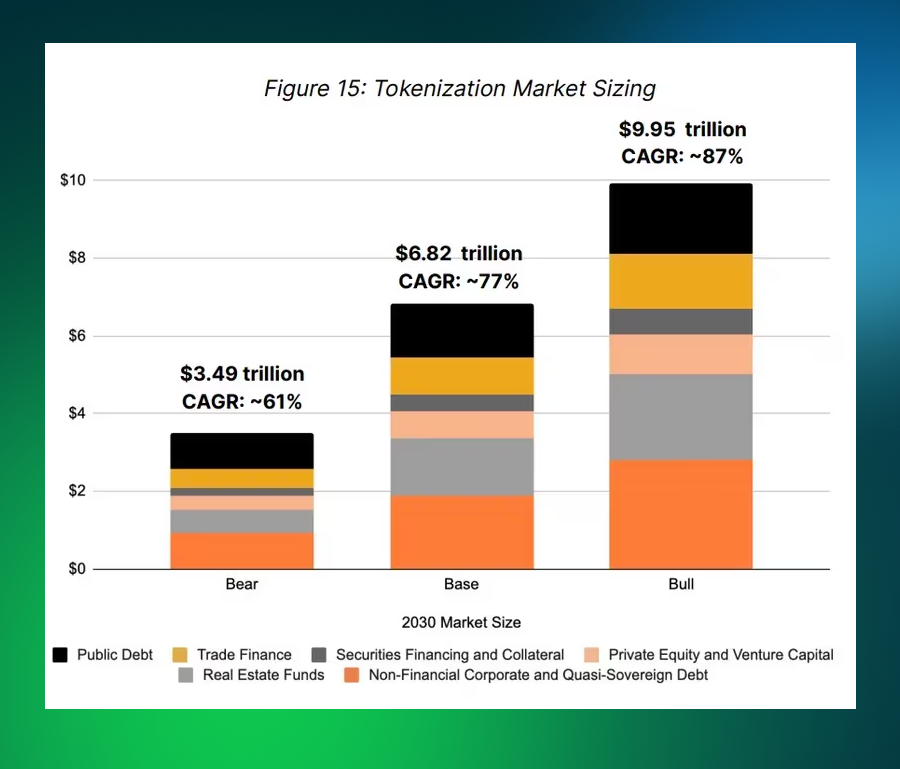

The same report by 21.co has three forecasts:

The chart divides real-world assets into six categories and then uses them to give projections of where things can be by the end of 2030.

In another forecast, Boston Consulting Group projects tokenized financial assets to be valued at $11 trillion by 2030.

Most of the growth is projected to come from other assets that are not fiat currencies as can be expected. The current RWA market is dominated by the tokenization of fiat in the form of stablecoins. As this sector is almost saturated, future growth will come from other real-world assets being tokenized.

An example of this trend is US government bonds. In 2023, the tokenization of these assets grew 450%, making it the largest asset class to be tokenized over the past year. This is just one example of where the market is already moving. Singapore’s central bank has started testing tokenization with established financial institutions and working on a tokenized government bond fund. Asian countries such as Hong Kong, Japan, Singapore, the Philippines, and European countries such as Germany, Luxembourg, France, and Switzerland have tested issuing digital bonds as well. To date, only about $4 billion of tokenized bonds have been issued with the traditional global bond market valued at $130 trillion.

These facts give a glimpse into what the future holds for asset tokenization as governments and financial institutions are testing the tokenization of traditional digital assets such as bonds. Once more regulatory clarity is given and more products and services come into the market, asset tokenization can take its next leap forward.

Looking for more content on real-world asset tokenization using blockchain technology?

EMURGO has partnered with NFT and Tokenization platform NMKR to drive the adoption of asset tokenization leveraging the Cardano blockchain via NMKR.

Follow EMURGO on X to receive more updates on tokenization and future in-person events with NMKR.

About EMURGO

- Official Homepage: emurgo.io

- X (Global): @EMURGO_io

- YouTube: EMURGO channel

- Facebook: @EMURGO.io

- Instagram: @EMURGO_io

- LinkedIn: @EMURGO_io

Disclaimer

You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by EMURGO to invest.