Real estate is one of the most common and largest asset classes. To this day, many people consider real estate an investment and a long-term store of value. As a traditional asset class, huge sums of money are stored in real estate with the support of borrowing and lending services from banks and other financial institutions.

However, investing in real estate can also have some drawbacks.

Depending on the location, asking price, and type of real estate, the asset can be relatively illiquid requiring much effort to match buyers and sellers. Access to financial services to acquire real estate can be limited for potential buyers due to credit history, geographical location, citizenship status, etc.

There can also be a lack of transparency and accountability with land registry information, tax history, and other administrative paperwork depending on the country location of the desired real estate. It could be difficult for would-be buyers from different countries to easily buy portions of their preferred real estate due to legal and financial restrictions.

Some of these drawbacks could be partially or wholly solved by using blockchain technology to tokenize real estate assets.

In this blog, let’s explore how real estate property can be fractionalized using digital tokens, its implications, and the future of real estate transactions in the age of blockchain.

Fractional ownership refers to a collaborative investment strategy where multiple parties own portions of a real estate property, like a residential home, condominium, apartment, or commercial real estate. This modality of ownership offers each investor specific ownership rights and entitlements to the asset based on their contribution.

In some cases, proprietors split ownership by using a legal entity, meaning that a separate legal entity owns the actual property.

Related reading:

- Explaining asset tokenization

- What are NFTs and metadata?

- How NMKR leverages Cardano for asset tokenization

Another legal structure for fractional ownership is the Tenancy-in-common (TIC) which provides all the individual tenants with a deed for a fraction or percentage of a commercial or residential property. The TIC allows individuals to own different percentages of the property but share it equally.

Another common type of real estate investment method is through a real estate investment trust (REIT). A REIT is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool capital investors who earn dividends from real estate investments. Investors do not individually buy, own, manage, or finance the properties. It is a simple way for investors to gain investment portfolio exposure to real estate, yet do not enable them to own the property.

However, when real estate is tokenized and sold through a secondary market, the token holders own the fractionalized portion of the real estate.

REITs also have other fees that investors must pay, including asset management fees, acquisition costs, and other expenses.

As of now, REITs are listed on major stock exchanges, providing liquidity and an opportunity for investors to invest in real estate. Yet, the investors are responsible for paying fees and do not own the properties outright. With more regulatory clarity for real estate tokenization coupled with more technical development of real estate tokenization platforms and solutions using blockchain technology, the market for real estate tokenization can expand quickly in the future.

The barrier to making fractionalized ownership a widespread modality is the complicated part. It is difficult to set up, find, and transact properties that offer this option on an instantaneous global scale, especially via the Internet.

Yet, using blockchain technology and NFTs, a piece of real estate can be instantly fractionalized and tokenized, and digitally represented as an NFT. The NFT contains all the necessary information regarding the real estate asset such as address, type of property, value, insurance status, transaction history, ownership, etc. in the token metadata.

A legal entity can then take possession of the whole NFT as a custodian and issue fractionalized tokens representing a portion of the total value of the NFT. These tokens are then sold to global individual investors who can buy as much of the property as they wish using their digital token wallet which contains the NFT. This would also allow for quick transaction settlement on a global scale with real-time transparency as transactions can be looked up using blockchain explorers.

In most cases, these fractionalized NFT tokens would be considered securities. People looking to buy them would have to go through the usual KYC & AML procedures to be able to buy a token share using a regulated marketplace platform for real estate trading. Properties are part of the securities market, and shares of those properties inherit the same regulatory framework.

These tokens could be freely issued and distributed using a decentralized blockchain ledger. Each token would appreciate by the same percentage as the whole property. This means an individual investor can control how much exposure they are willing to tolerate per property.

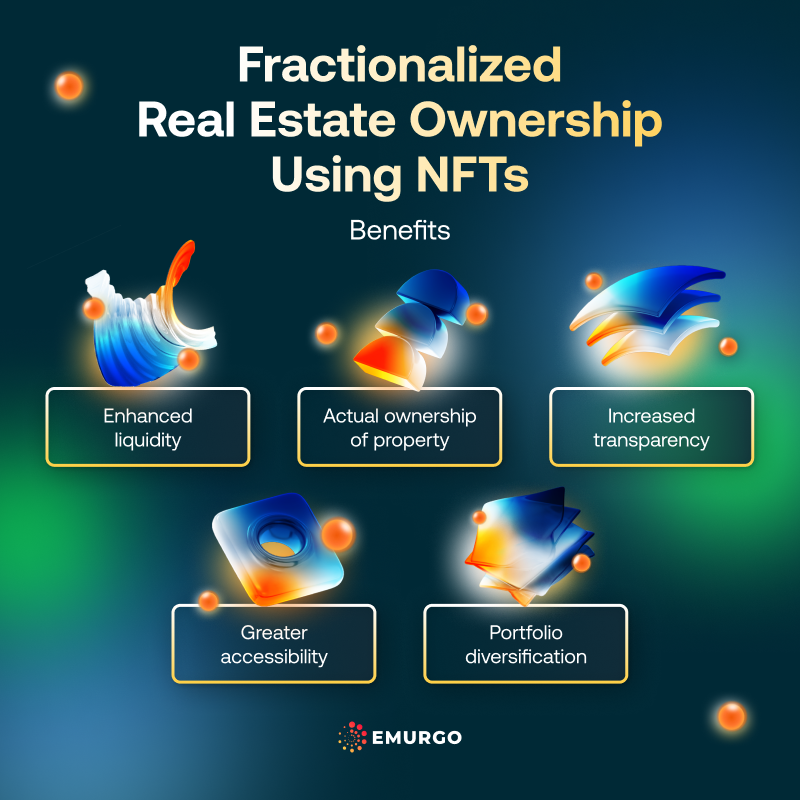

Here are some advantages to this mode of property ownership:

Enhanced liquidity: Real estate is a relatively non-liquid asset. It takes time and effort to match buyers and sellers and find rental tenants. The tokenization of property completely changes this reality. Fractionalized NFTs can be freely issued and traded on secondary markets enhancing the liquidity of the entire asset class. This would spur demand for building regulatory frameworks and marketplaces to facilitate the trading of fractionalized real estate NFTs.

Increased transparency: Decentralized blockchain technology ensures that all real estate transactions are recorded and accessible to token holders. Transactions can be searched in real time using blockchain explorers. Token metadata would enable anyone to view important relevant information about the real estate asset. The information would be immutable and censorship-resistant. This gives a heightened sense of security and trust between buyers and sellers. In some parts of the world, there is a lack of transparency and accountability within local governments and with property owners which makes it difficult for buyers to trust the asset they wish to purchase.

Accessibility: Fractionalized tokens lower the investment barrier for all types of investors. Theoretically, anyone with the necessary funds could buy fractions of real estate properties with an internet connection regardless of their residency location and amount of liquid funds available. There would be less of a need to rely on banking services to grant access to mortgages. People in one country could more easily invest in real estate of their choice in another country.

Portfolio Diversification: Investors could buy fractionalized shares in several different properties. Rather than having to secure a large amount of funds for a single property, they could choose to invest in several fractionalized portions of tokenized properties. This reduces the risk profile of real estate investments and ensures people can create diverse property portfolios according to their risk tolerance.

NMKR is an NFT and tokenization service leveraging the Cardano blockchain. It plans to add more tokenization functionalities to its NMKR Studio tool, including open-source smart contract tokenization.

To date, NMKR’s platform has issued more than 2.2 million NFTs with an overall transaction volume surpassing $65 million for more than 30,000 projects.

NMKR has already demonstrated a successful use case for asset tokenization through its partnership with Tiamonds to tokenize and sell NFTs of physical diamonds. These NFTs are issued and sold in a 1:1 ratio with each physical diamond insured and stored in vaults. This has enabled diamond buyers and investors to purchase diamonds, gain access to verified information about the purchased diamond through token metadata, and be able to redeem the NFT for the actual diamond at any time.

Read more: A case study into the tokenization of diamonds through NMKR

NMKR has also helped to tokenize e-books with Book.io to create true digital book ownership. Currently, when people buy an eBook or Audiobook, they do not technically own it. Readers are only allowed to read or view without the ability to resell them on secondary marketplaces. The tokenization of such books using NMKR’s tokenization technology now empowers ebook readers to simply own and transact their e-books as desired.

Want to stay on top of the latest news about real-world asset tokenization using Cardano?

Follow EMURGO on X to receive these updates.

About EMURGO

- Official Homepage: emurgo.io

- X (Global): @EMURGO_io

- YouTube: EMURGO channel

- Facebook: @EMURGO.io

- Instagram: @EMURGO_io

- LinkedIn: @EMURGO_io

Disclaimer

You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by EMURGO to invest.