Commodities have traditionally been used as a separate asset class to diversify investment portfolios, usually composed of stocks, bonds, and real estate. They are considered tangible or real-world assets, with oil, precious metals, raw materials, etc. serving as examples.

With the real-world asset (RWA) tokenization narrative gaining more attention lately, more blockchain projects and traditional finance companies are looking deeper into this sector to gain a competitive edge.

In a previous blog, we discussed more about the various benefits, challenges, and implications of tokenizing real estate. In this blog, we’ll take a similar look at commodities and how tokenization can affect this asset class.

Key Takeaways

- Tokenization is the process of representing real-world or digital assets as tokens issued on a blockchain. Once tokenized, assets can be transacted with greater ease, security, and transparency.

- Tokenized commodities offer benefits like increased liquidity, cost efficiency, global reach, transparency, and efficiency.

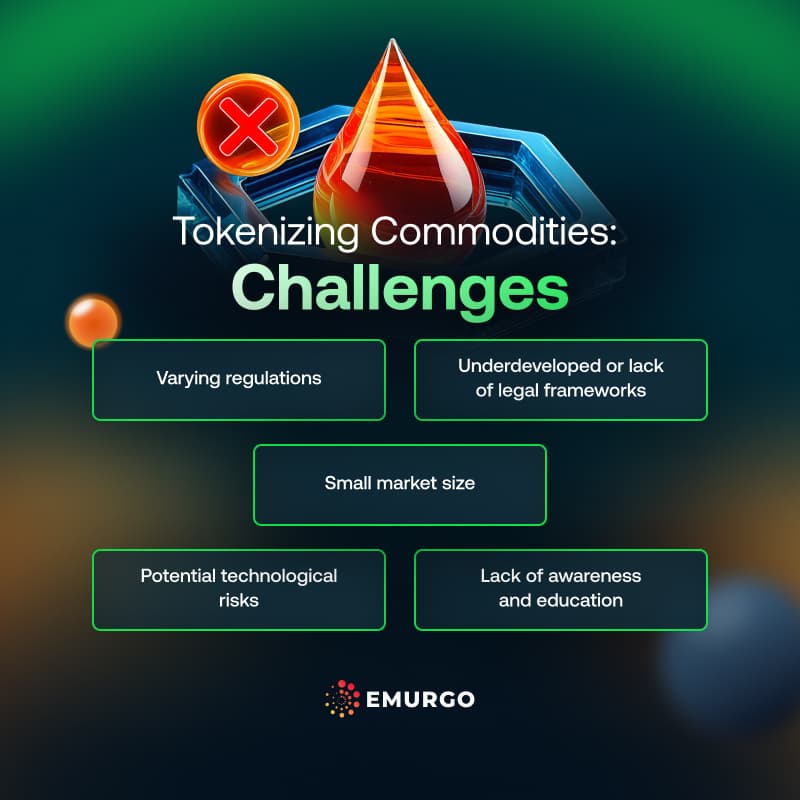

- Challenges to commodities tokenization include varying regulations, underdeveloped legal frameworks, market adoption, technological risks, and lack of awareness and education.

- RWA platforms and tokenization providers offer tools to tokenize assets.

Explaining Tokenization

Asset tokenization refers to the process of converting real-world or digital assets into tokens that are issued and recorded on a decentralized blockchain. A blockchain is a coordinated network of distributed ledgers that verify and record transactions in real-time without a centralized administrator.

These tokens represent ownership or rights to the underlying asset and can be easily bought, sold, or transferred in a decentralized manner via supporting digital assets or crypto wallets. The tokens themselves can contain essential information and data related to the assets they represent, thereby providing more transparency and accountability to buyers and sellers. By being digitized, this potentially eliminates transactional borders and opens up accessibility to more investors, which brings in more liquidity. Transaction fees can be reduced by using a decentralized blockchain network and digital wallets with fewer middlemen involved, among other features.

Asset tokenization leverages a decentralized blockchain’s inherent transparency, security, and immutability to create a more efficient, accessible, and inclusive system for asset management and trading. These can be done in several ways, and they have many pieces.

Related reading:

- Asset Tokenization 101

- Unique advantages of real estate tokenization

- Predicting the future of asset tokenization

Commodities Tokenization: Additional Benefits

In a previous blog on asset tokenization of precious metals, we listed some immediate advantages, including:

- More affordability: A tokenized asset can be fragmented into smaller chunks, enabling more individuals to buy the assets they desire with smaller amounts.

- Better security: Blockchain networks can transparently track transactions in real-time. Due to its track history and digital transparency properties, blockchain reduces the potential for human accounting errors.

- Verifiable authenticity: Tokenized assets can have a complete history of their origin that anyone in the market can verify. Using blockchain enhances the authenticity of precious metals for both buyers and sellers.

- Lower transaction costs: Trading physical precious metals involves fees and several intermediaries. Fewer middlemen for tokenized precious metals could make them cheaper and more efficient to transact.

- Wider access to a global market: Tokenization could potentially connect stakeholders globally and make it easier to participate in the logistics, purchasing, and/or selling of precious metals when appropriate.

Here are some additional benefits of tokenizing commodities:

- Simpler diversification: Tokenized commodities could potentially all be listed in a single distributed ledger. A user could have access to many different assets just by having a crypto wallet supported by the network. They would be able to choose any combination of risk they are willing to tolerate with a plethora of tokenized assets to diversify their portfolios.

- Integration with DeFi: Tokenized commodities could access a blockchain network’s decentralized finance ecosystem. As DeFi and tokenization develop more, there could be a wider availability of products and services integrated with tokenized commodities.

- Greater access to commodity assets: When people consider investing, they typically think of stocks, bonds, real estate, or opening a business. Tokenization presents an opportunity to widen access to investing in commodities in fractional portions if desired, giving them a wider selection of assets that can be uncorrelated with other traditional asset classes.

- Streamlined payments and settlement processes: Transfer and ownership are usually different events in traditional stock markets. In blockchain, these happen simultaneously when the transaction is confirmed by the network, making transactions more efficient for both buyers and sellers.

- Simplified KYC processes: Know Your Client is segregated by industry. Effectively, a person investing in real estate, commodities, bonds, stocks, and other sectors has to do KYC for each service separately. This is not only time-consuming and cumbersome but also presents a potential centralized risk of a data breach. Each of these services records personal data, and the user has no say in the security practices of the platform used for KYC. A single blockchain network can potentially offer this at once for all tokenized assets issued on its ledger. That means only one KYC process is needed if using that particular blockchain network for assets that have been tokenized on it.

Commodities Tokenization: Challenges

As with real estate and other asset classes, there remain several challenges to onboarding more users to commodities tokenization as well as getting more builders to develop such tokenization projects. These challenges include:

- Varying regulations: Tokenized assets often fall under securities or financial regulations, which vary by jurisdiction.

- Underdeveloped legal frameworks: Ensuring that tokens are legally enforceable representations of the underlying asset can be lacking or overly complex.

- Market adoption: The ecosystem for asset tokenization is still growing, and mainstream adoption requires robust infrastructure.

- Potential technological risks: Vulnerabilities in smart contracts or blockchain platforms can pose risks to tokenized assets.

- Lack of awareness and education: Many people are still unfamiliar with blockchain technology. Some concepts, such as wallets, private keys, and cryptographically signing transactions, are still foreign and need to be explained.

All these challenges can be addressed with time and resources. None of them outweigh the many benefits blockchain tokenization offers commodity markets and those who trade in them. In time, everything will be solved, and blockchain will become the preferred medium for these markets.

NMKR and Commodities Tokenization

NMKR is a pioneer in the commodity tokenization space. It’s one of the first Cardano projects to launch a tokenized asset on-chain. In this case, NMKR partnered with Tiamonds to mint NFT, which represented diamonds.

The diamonds were held in a secure vault, and each NFT represented ownership of an individual stone. The owners could freely trade the tokens and use the NFT to redeem the physical diamond from the custodian at any point.

To learn more about NMKR and its tokenization services, visit here.

Follow EMURGO on X and LinkedIn to Learn More About Tokenization

Are you a business or developer wanting to learn more about getting started with RWA tokenization, NFTs, and more?

Then, follow EMURGO on X and LinkedIn for regular content and updates on the latest in asset tokenization.

About EMURGO

- Official Homepage: emurgo.io

- X (Global): @EMURGO_io

- YouTube: EMURGO channel

- LinkedIn: @EMURGO_io

Disclaimer

You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by EMURGO to invest.